Trend Alert: Mos

Voxburner Content Team

Article Highlights

Be the first to access new posts and exclusive content

Trend Alert introduces you to the latest trends that are impacting the daily lives of 16-24s.

When talking about the key characteristics of Gen Z, we often describe them as “smart spenders.” Growing up during a recession and more recently seeing the financial impact of COVID has shaped their values around money. They are extremely savvy about how to get the best value for money on purchases, adept at navigating online shopping and discount services. They also think ahead when making decisions such as what degree subject to study or what internships to apply for, considering the earnings potential of each option. However, our research has found that they don’t feel well educated on financial matters or confident in navigating financial decisions.

Students are a key target market for banks, as heading off to college or university is a common time to set up your first bank account. Therefore, all the major banks run special offers or specific student accounts, tailored to the needs of this demographic. Additionally, there are an increasing number of startups in the finance space targeting Gen Z with products created just for them. One example is Mos, a business founded in 2018 with the aim of building a “financial super app” for young people, according to a Time interview with its founder Amira Yahyaoui. The startup has raised over $17 million according to Crunchbase, and investors even include rapper Jay-Z.

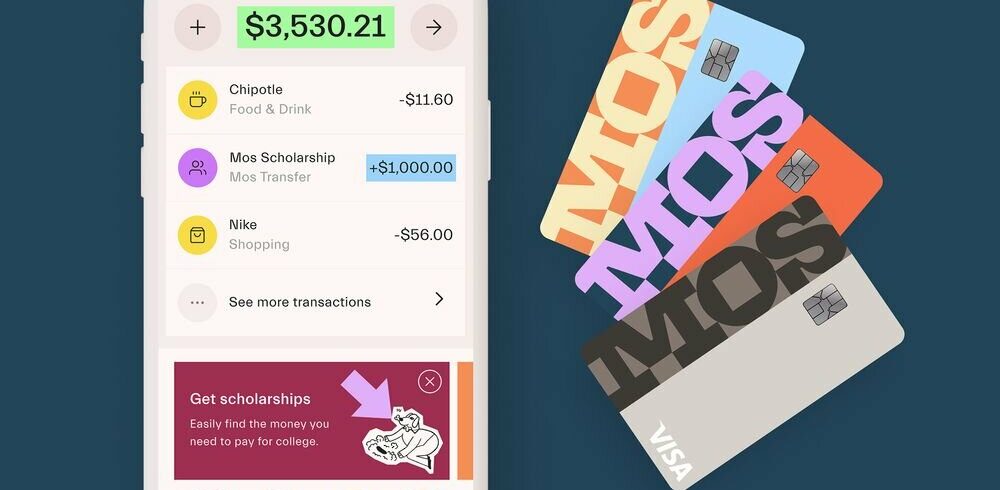

Mos can be compared to challenger banks like Monzo and Revolut, as it provides customers with a debit card that can be used online and in-person. Users can even choose to have their salary paid into their Mos account. However, the key attraction of Mos for many young people is the support they offer US students in securing financial aid for college. While education is the top priority of the average 16- to 24-year-old, student debt is a huge concern for those who do attend college and take out student loans. For those from underprivileged backgrounds, it can be a blocker to attending college at all, which is why Mos wants to connect students with financial aid to level the playing field, ensuring further education isn’t simply for the wealthy.

So far, Mos has helped over 400,000 students successfully secure financial aid for college, and the company’s future plans include helping its young customers take out mortgages, secure auto loans, and even find jobs. But for the moment, its colourful branding and attention-grabbing slogans, such as “Find free money for school and life,” will set them on their way to engaging young people looking to navigate the confusing financial landscape and overcome the challenges they’ve faced reaching adulthood in a pandemic.

Want more stories like this? Subscribe to our newsletter for weekly updates on the latest youth trends direct to your email inbox.